The unprecedented effect of the COVID-19 pandemic on the U.S. economy and all the related uncertainties, including on the regulatory approval process, put into motion the termination of the merger agreement between First National Bank in Howell and Arbor Bancorp, the holding company of Bank of Ann Arbor.

The merger had been announced in February. In the all-cash transaction, shareholders of First National Bank were to receive $3.65 per share in cash for each share of FNBH Bancorp common stock outstanding, resulting in a deal value of over $101 million.

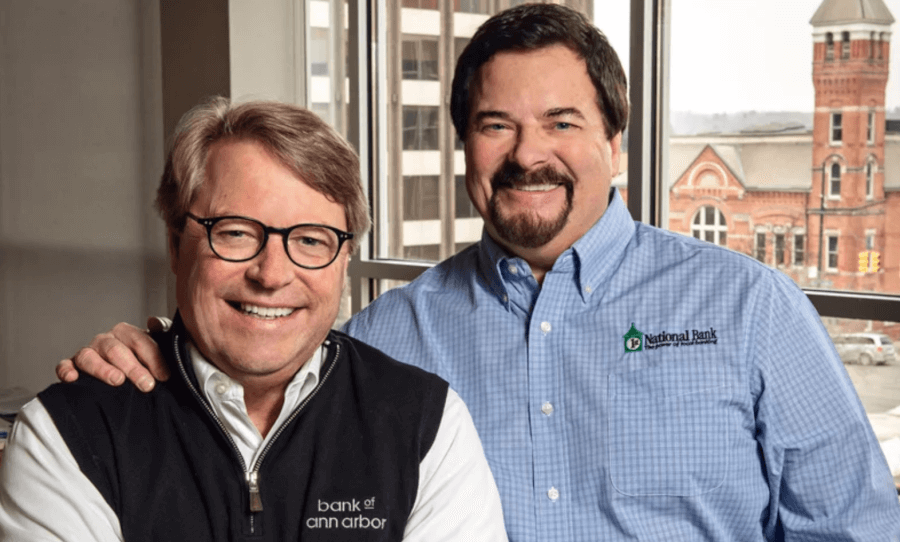

“While both companies believe in the benefits of the merger, we believe it would not be prudent at this time to continue with the merger and integration of our companies given all of the economic uncertainty,” said Tim Marshall, president and CEO of Arbor. “Like we have done before during periods of heightened economic risk and uncertainty, we believe it’s warranted to play defense and take an internal-focused approach to our business right now.”

Ron Long, FNB President and CEO, agreed.

“There are just too many unknowns to press on with the deal at this time,” Long said. “There’s a wide range of economic possibilities here. We, too, believe a caution-first approach is warranted at this time.”

Marshall and Long said in no way does this termination reflect changes to either bank’s financial position. In fact, both said they have discussed ways in which they can do business with one another going forward.